When Congress passed the 2018 Farm Bill, it explicitly legalized the sale of hemp and its derivatives such as CBD. Farmers across the nation relied on this government action, and invested considerable time and resources to plant, grow, and market commercial hemp crops, and particularly for the market for which there is immediate processing infrastructure and consumer demand: hemp-derived CBD and cannabinoids.

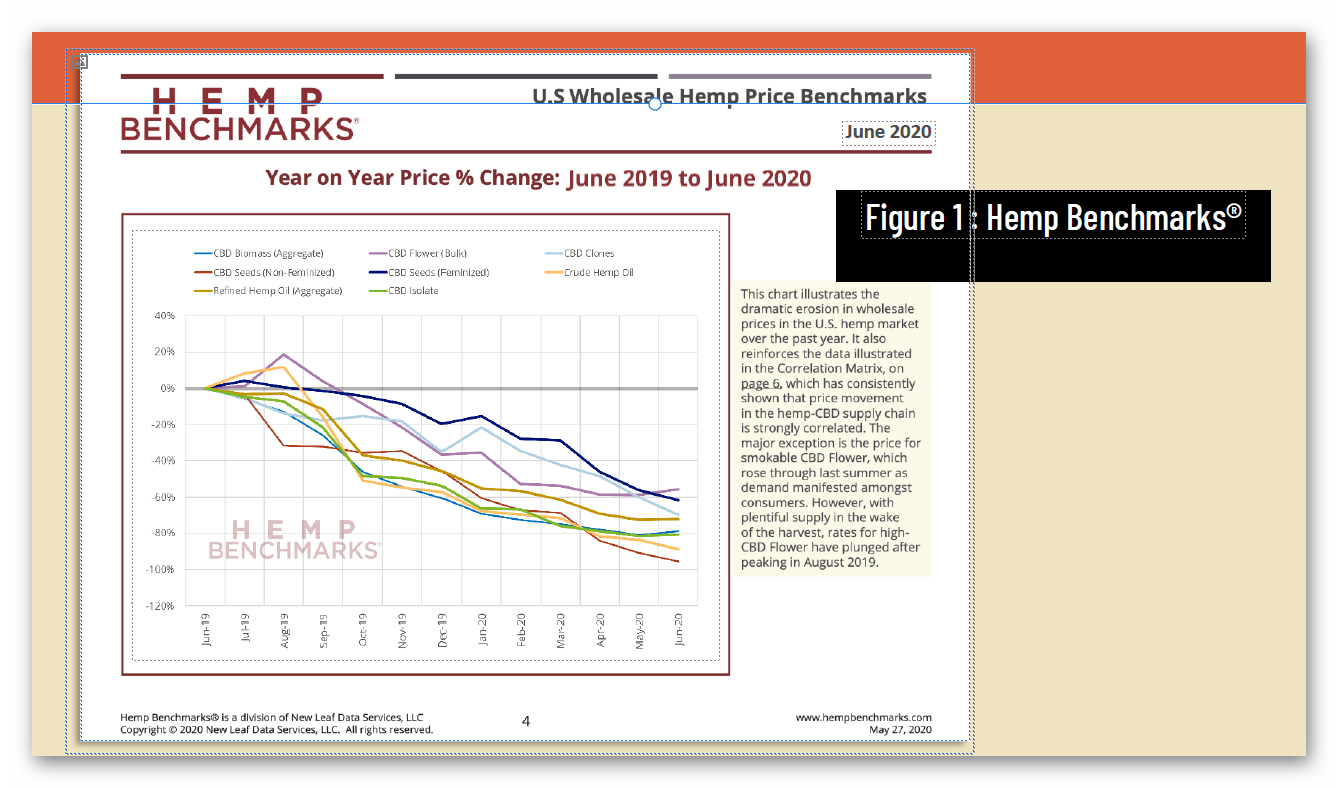

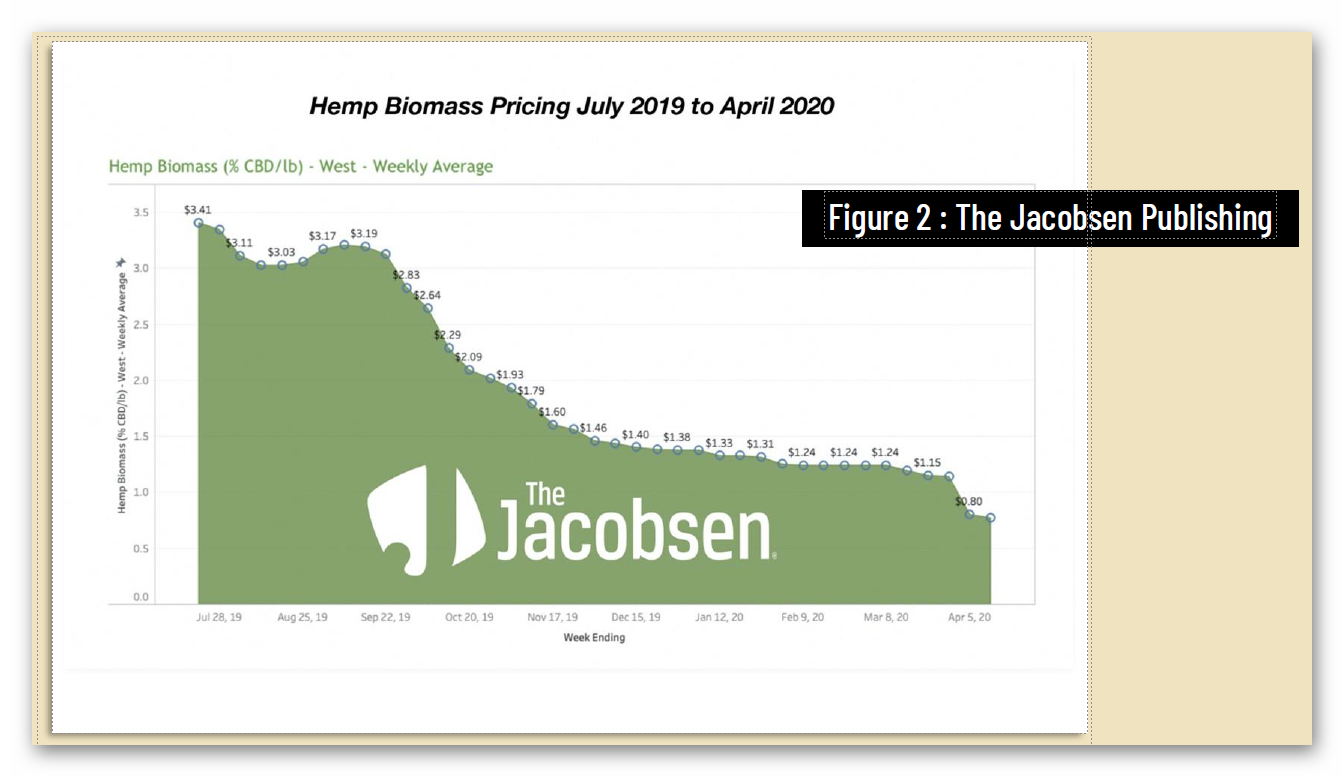

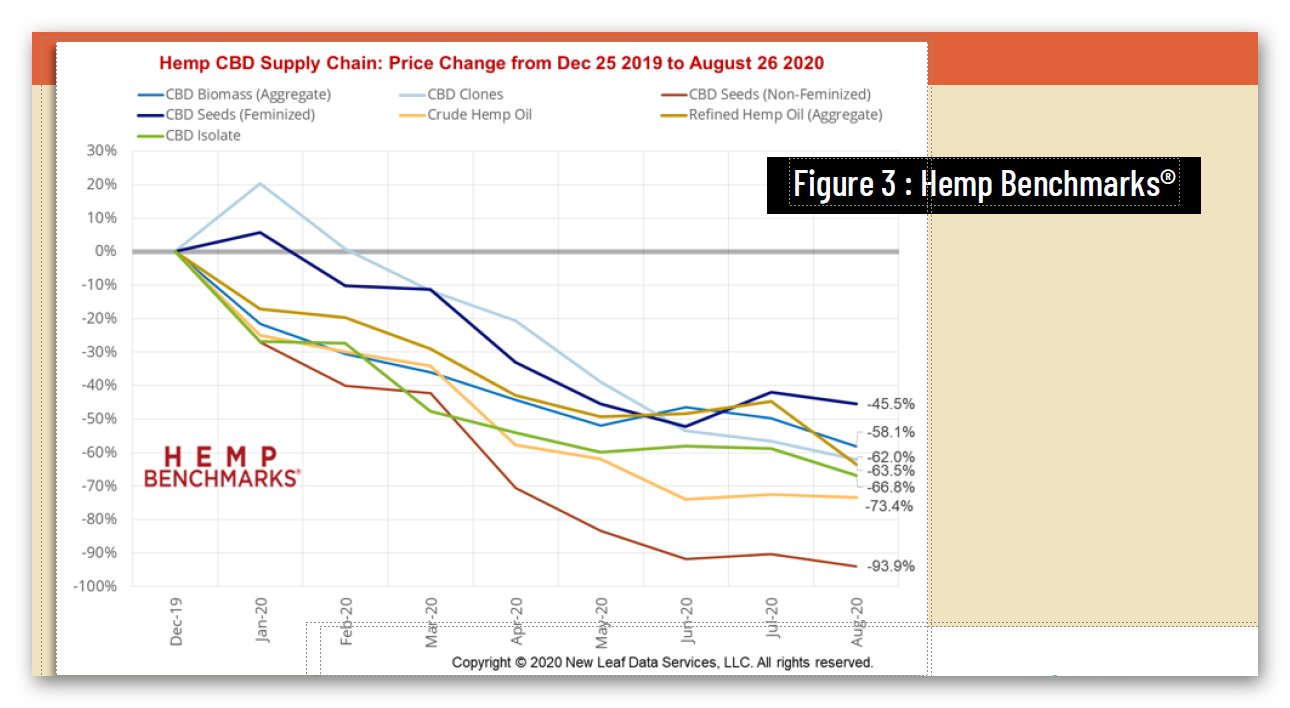

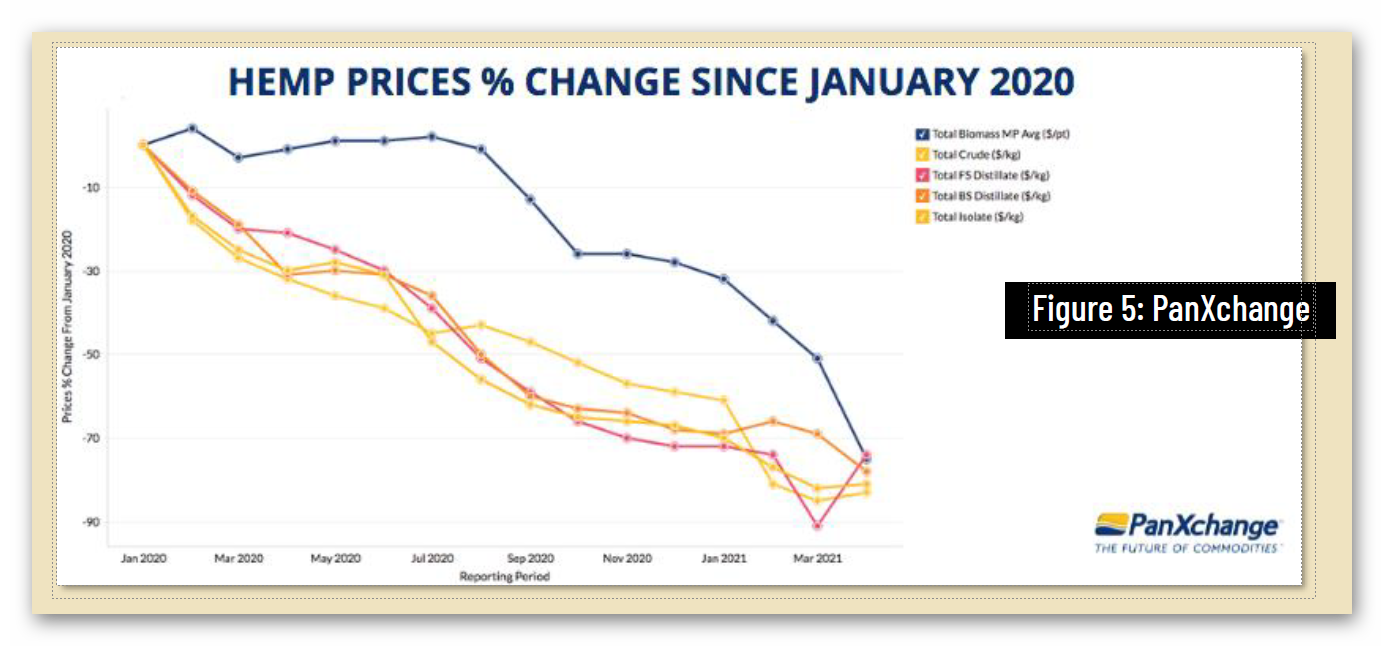

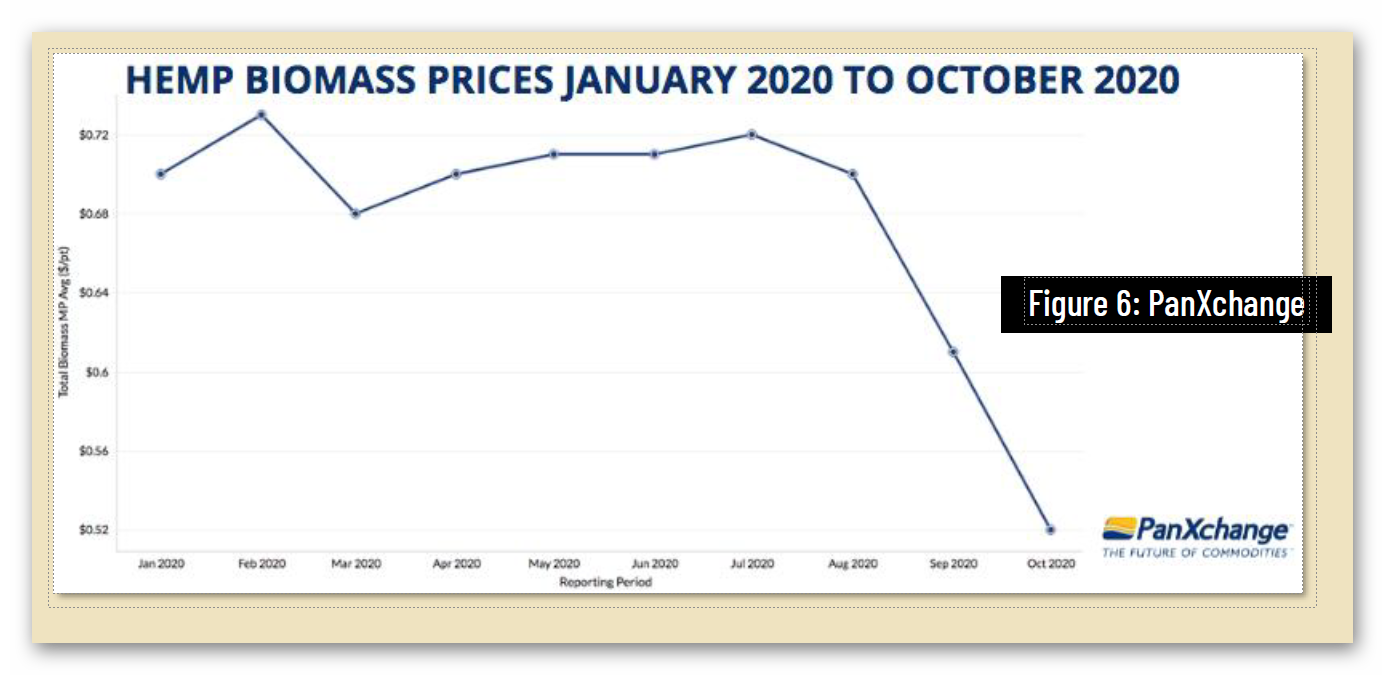

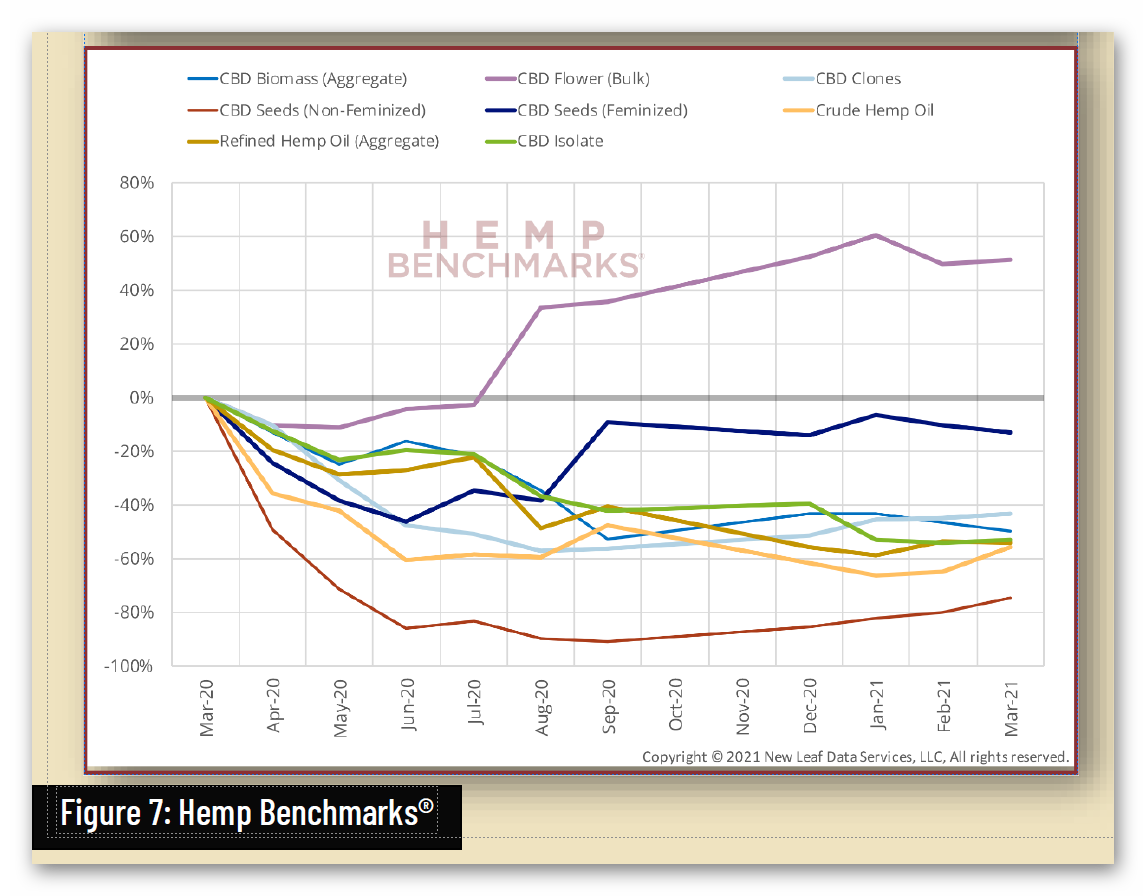

Unfortunately, federal regulatory uncertainty regarding hemp-derived CBD has severely impacted the hemp market, with reduced manufacturing demand resulting in a more than 90% commodity price decline, crushing opportunities for U.S. farmers. And while scientific research has demonstrated CBD’s strong safety profile – including a 2021 study that addresses concerns about liver toxicity in typical CBD products – FDA has indicated that it will not, on its own, establish a legal pathway for its sale, claiming that current law puts the agency “in a stalemate position.”

The pressing consumer health and safety problem, indeed, is a product of FDA’s inaction. Unregulated products being deceptively marketed as hemp or CBD continue to proliferate, some of which raise significant quality, safety and other consumer protection concerns. Worse, the commodity price collapse has led some to chemically convert surplus hemp CBD biomass into intoxicating products, such as Delta-8 THC, which are being sold at retail, sometimes to minors. The time for action is now.

H.R. 6134 would ensure that hemp-derived CBD, and other non-intoxicating hemp ingredients, could be lawfully marketed as food and beverage additives. This would also require CBD products and hemp extract product manufacturers to comply with the entire existing comprehensive regulatory framework, which ensures that the products are deemed safe, properly labeled and prepared utilizing Good Manufacturing Practices.

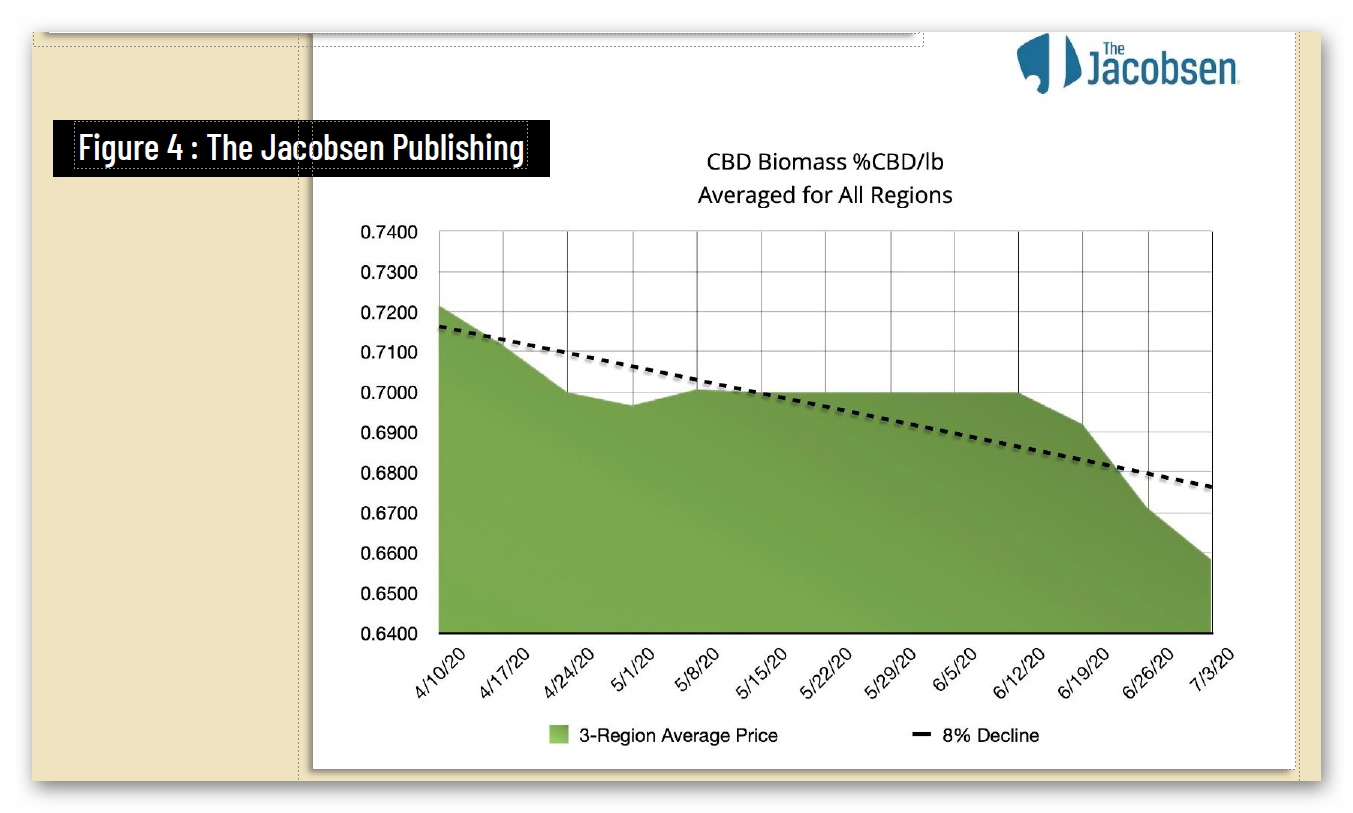

Failing to establish a regulatory pathway for legalizing hemp-derived CBD will continue to reduce economic opportunity for U.S. hemp farmers and deny consumers access to safe, quality products. H.R. 6134 would help stabilize the hemp markets, open up a promising economic opportunity for U.S. agriculture and honor the commitment made to growers in the 2018 Farm Bill.

Once FDA does legally recognize and regulate CBD products, the hemp industry can provide a needed financial jolt to a nation emerging through economic recovery. Regulatory relief for the hemp-derived CB□ industry constitutes an economic stimulus package for the nation’s farmers and small businesses without requiring one dime from the American taxpayer.

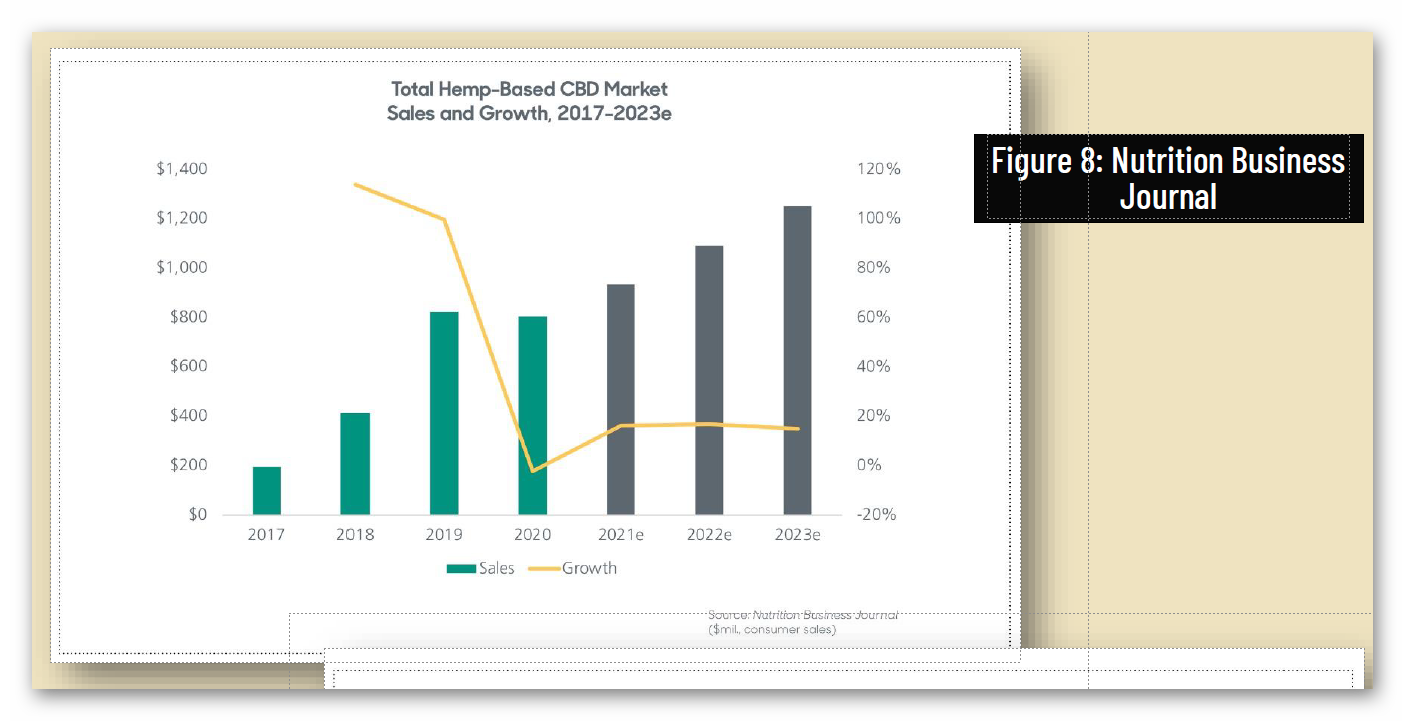

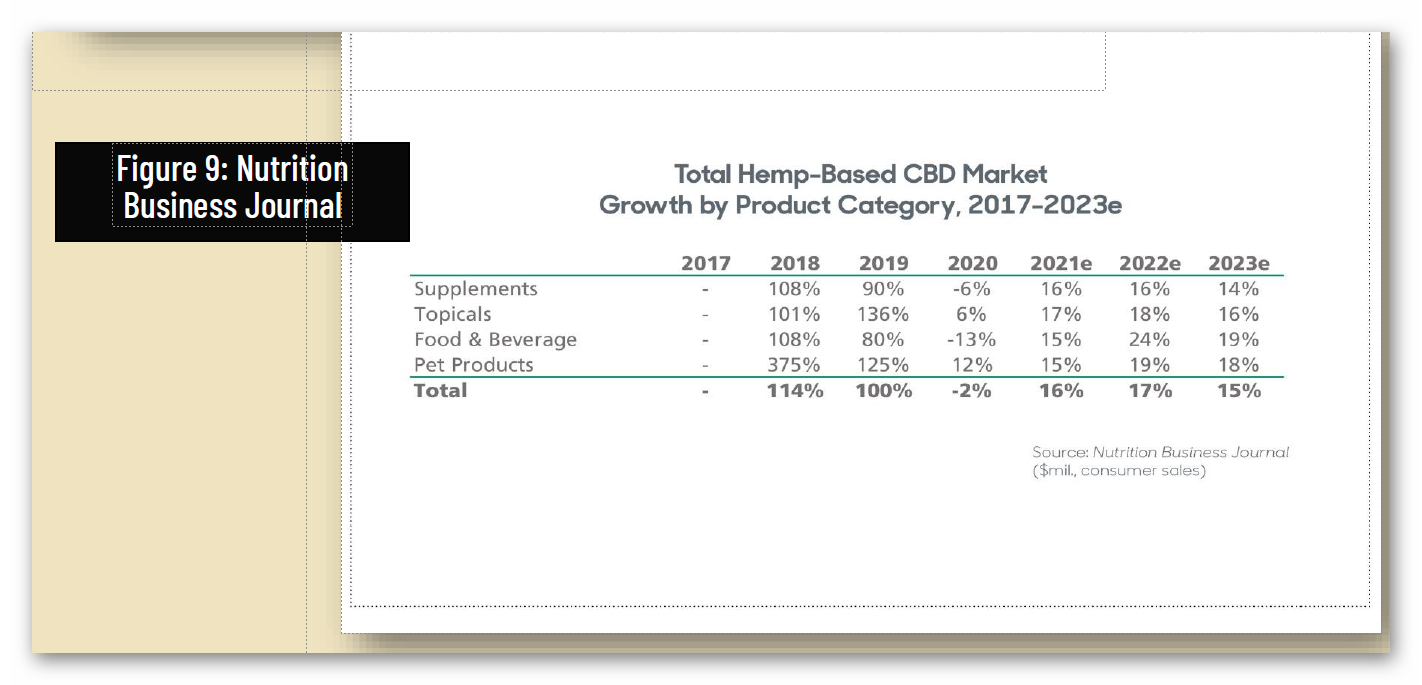

Independent surveys predict that with a regulatory pathway, sales of CBD products would grow from approximately $1.2 billion in 2019 to anywhere from $10.3 billion to $16.8 billion market by 2025.

Lead Congressional Sponsor

Rep. Kathleen Rice (D-NY)

Congressional Cosponsors

Democrats = 4 | Total = 6 | Republicans = 2

REP. MORGAN GRIFFITH (R-VA)*

REP. ANGIE CRAIG (D-MN)*

REP. DAN CRENSHAW (R-TX)*

REP. TONY CARDENAS (D-CA)

REP. CHELLIE PINGREE (D-ME)

*=ORIGINAL COSPONSOR

U.S. HEMP ROUNDTABLE’S REPORT TO CONGRESS:

F EDERAL REGULATION NE EDED URGENTLY TO

HONOR COMMITMENT TO U. S . HEMP FARMERS

In passing the 2018 Farm Bill, Congress made clear its intent to support the production and sale of hemp and hemp derivatives such as CBD.1 Thousands of U.S. growers planted hemp in response, with farming for CBD representing the overwhelming majority of all hemp acreage.2 However, public statements by FDA officials arguing that it is illegal to sell ingestible hemp-derived CBD products have taken their toll on the industry. While the agency has primarily taken action against companies that have made improper disease claims, and while FDA officials have announced that they are investigating a regulatory pathway for CBD products, CBD commerce and investment have been chilled due to the absence of federal

regulation, impairing economic opportunity for farmers and small businesses:

• The current regulatory gray area has stifled significant hemp market opportunities for farmers and businesses. State and local agencies have threatened and/or taken enforcement actions against the sale of CBD products, citing FDA guidance. Many big-box retailers are reluctant to carry CBD products due to FDA’s position, while Big Food companies have delayed efforts to introduce new CBD-infused products into the marketplace.3

• There is also a disturbing trend in hemp-related litigation across the country. More than a dozen class action lawsuits regarding CBD have

been filed, citing FDA’s public statements as grounds for injury.16 Even more cases have been brought by farmers against processors for nonpayment

and breaching hemp contracts.17 These lawsuits are tying up cash and disrupting business operations and supply chains.

• Federal and state political leaders of all stripes have repeatedly called on FDA to issue formal regulations for CBD in dietary supplements and

food. U.S. Senate Majority Leader Mitch McConnell and Senator Ron Wyden have each urged FDA to take expedited action,18 while Kentucky

Commissioner of Agriculture Ryan Quarles has insisted that FDA end its “bureaucratic paralysis.” Quarles witnesses FDA’s inaction as

“preventing growth in the hemp marketplace…Promising potential markets remain closed while crop production has increased. When there

is a surplus of crop and it begins to pile up, the result is obvious: crop prices will fall.”19

• FDA is acutely aware of the broad public support for CBD regulations, but has beem unwilling to act. Former FDA Commissioner Scott Gottlieb testified that “[FDA] heard Congress loud and clear…Congress wants there to be a pathway for CBD to be available.”20 Former FDA Commissioner Stephen Hahn stated it would be a “fool’s game” to try to completely shut down the CBD marketplace.21 Current Acting Administrator Janet Woodcock has tried to combat the perception that FDA is opposed to CBD in dietary supplements as a matter of policy. However, she argues that the “law is very clear about this, and so it puts us in a stalemate position.”22

REGULATION MEANS SAFETY: FDA also argues it is hesitant to act because it has not yet accumulated sufficient safety data on CBD. However, public safety data is compelling, and regulation is the only approach to ensuring public health and safety:

• There’s a growing body of evidence, including data published by the industry, demonstrating that hemp-derived CBD, especially at the levels found in many dietary supplements and food, is generally safe.23 In fact, the preliminary findings of a March 2021 clinical study reported “no evidence” of liver toxicity in adults consuming hemp-derived CBD products at serving size ranges that are standard in the marketplace.24 Scientific experts have recognized that data already exists to determine that hemp extracts containing CBD can be Generally Recognized as Safe (GRAS).25 And despite a notable increase in the use of these products, the number of reported adverse events continues to be remarkably low.26

• Other international regulatory bodies have reviewed the same publicly available evidence and determined that CBD products can be safely marketed. The World Health Organization determined that pure CBD is “generally well tolerated with a good safety profile” and presents little risk of abuse or dependency potential, recreational use, or public health-related problems.27 Australia’s Therapeutic Goods Administration concluded that CBD “presents a good safety and tolerability profile,”28 and in December, approved CBD products, up to a maximum of 150 mg/day, for use in adults, to be supplied over-the-counter by a pharmacist, without a prescription.29 United Kingdom’s Food Standards Agency determined that CBD products can be regulated and marketed as novel foods, provided they meet standards for safety and content, recommending a 70mg daily limit for healthy adults.30

• Recognizing CBD’s safety as well as the need for consumer protection, a majority of U.S. states now provide explicit legal protection for the sale of ingestible hemp-derived CBD products, and new regulatory regimes have emerged in the nation’s largest wellness markets, such as California, New York, Florida and Texas.31 While this is good news for farmers and consumers in these states, the cloud of federal legal uncertainly looms over interstate commerce. Worse, according to a recent Consumer Brands Association study a contradictory state patchwork of laws and regulations have led to deep public confusion and impose significant compliance burdens on farmers and manufacturers.32

• The most pressing safety problem is, as independent studies demonstrate,33 and as FDA recently reported to Congress,34 without a clear regulatory framework, bad actors are selling products without appropriate safeguards and misleading consumers with false label claims.

Further, there’s been a rise of products, such as Delta-8 THC, which are being marketed under the guise of the hemp name for their intoxicating effect.35 Regulation is needed to crack down on these controversial products and ensure that the dietary supplement lane is

limited to non-intoxicating hemp ingredients.

REGULATION PORTENDS A BRIGHT FUTURE: Once FDA does legally recognize and regulate CBD products, the hemp industry can partner with the agency to provide a needed financial jolt to a nation emerging through economic recovery. Regulatory relief for the hemp-derived CBD industry constitutes an economic stimulus package for the nation’s farmers and small businesses without requiring one dime from the American taxpayer:

• One economic survey predicts that “widespread, easy access to CBD products at traditional retail outlets will drive a surge in CBD sales,” projecting sales to grow from approximately $1.2 billion in 2019 to $10.3 billion by 2024.36 Another study estimates a $16.8 billion market by

2025, should FDA create a regulatory pathway for ingestible CBD, lowering previous projections because “inaction by US FDA is constraining the growth of the US CBD market.”37 A third analysis projected a CBD sales range of $4 billion to $16.5 billion by 2025, the higher end dependent on favorable FDA regulations.38 A fourth study projects a $5.3 billion in retail sales in 2021, with expectations to grow at a 25 percent compound annual growth rate over the next five years, assuming the FDA comes out with a regulatory framework for the industry.39 A fifth study projects CBD sales to reach $19.5 billion by 2025, with mainstream retail exceeding $15 billion annually, but that’s based on a prediction that FDA will regulate CBD as a food additive in 2022.40 Other hemp constituents, such as CBG and CBN, are also providing new economic opportunities for U.S. farmers and could flourish in a regulated system.41

• Wider availability through additional retail venues and product manufacturers would address consumer demand and help stabilize hemp prices, posing tremendous economic opportunity to U.S. farmers struggling through the pandemic. One economic study forecasted that hemp sown for CBD could potentially generate substantially more revenue per acre than corn.42 Clear laws and regulations would also empower farmers to get out of the court system and into the hemp fields, with more secure access to banking, merchant services, and

marketing opportunities.

• Unlike many existing industries that will have to rebuild over the next few years to achieve their previous stature, the hemp industry needs no ramp-up period; sales would surge once regulations are in place. Unlike existing industries that will struggle to return workers to their

jobs, the hemp industry will offer brand new jobs immediately in agriculture, manufacturing, distribution, retail, testing and other fields that serve the hemp supply chain.

• Limiting CBD to a drug-only path remains a deeply anti-consumer approach. CBD is only FDA-approved for very rare medical conditions, and costs patients up to $35,000/year.43 A drug-only path would block access for the millions of Americans want to use non-prescription hemp derived CBD to help manage their everyday health and wellness. CBD can coexist as an ingredient in both drugs and supplements, but under different regulatory frameworks just like fish oil, niacin, caffeine, menthol, and many other natural ingredients do today. Dietary supplement regulations are intended to strike a balance between consumer safety and consumer access. If vitamins, minerals, and botanicals were regulated like drugs then they would be too expensive for the millions of people that use them for good health.44 CBD regulated as a dietary supplement provides appropriate consumer protections, quality control and transparency. Supplement regulations require manufacturers to conduct pre-market safety evaluations and to follow FDA’s guidelines for manufacturing and testing, as well as maintain post market surveillance for adverse events.

• A partnership in which FDA regulation is complemented by industry initiatives such as U.S. Hemp Authority self-regulation45 also helps ensure that consumers can purchase safe, transparent, quality-assured products.

Paid for by U.S. Hemp Roundtable, Inc., an independent, nonprofit organization exempt from federal taxation under section 501(c)(4) of the Internal Revenue Code.

www.hempsupporter.com

1 https://www.mcconnell.senate.gov/public/index.cfm/pressreleases?ID=0B71B14E-5F77-4283-9084-561F67EFBC70 (Senate Majority Leader Mitch McConnell: “Congress’ intent was clear with the passage of the Farm Bill that these products should be legal, and our farmers, producers and manufacturers need clarity as well as a workable pathway forward regarding the Agency’s enforcement and potential regulatory plans for certain CBD products”); https://www.wyden.senate.gov/download/062519-wyden-letter-to-fda-hhs-on-hemp-cbd-

(Senator Ron Wyden: “The passage of the 2018 Farm Bill is Congress’s clear intent to further advance and support the domestic production and sale of hemp and hemp derivatives like CBD.”)

2 https://www.reporterherald.com/2020/05/18/enthusiasm-leads-to-oversupply-of-hemp-in-colorado/ (Colorado: 79% of acreage in 2020 dedicated to hemp grown for CBD products.); https://www.kyagr.com/marketing/hemp-overview.html (Kentucky: 92% of hemp acreage grown for CBD in 2019.)

3 https://www.barrons.com/articles/hemp-cbd-demand-is-poor-prices-are-falling-in-a-blow-to-farmers-51580482811 (“Consumer packaged-goods giants like PepsiCo (PEP) and big retailers like Walmart (WMT) haven’t committed to CBD-laced products. A big reason is concerns voiced by the U.S. Food and Drug Administration, which says it can’t permit the biologically-active ingredient in food and drink without tests of CBD’s safety.”)

4 https://hempsupporter.com/assets/uploads/USHRHempPricingData.pdf; https://wfpl.org/hemp-prices-crash-leaving-ohio-valley-farmers-feeling-burned/ (“The price of CBD-rich hemp has crashed, dropping more than 75% in 6 months.”); https://www.barrons.com/articles/hemp-cbd-demand-is-poor-prices-are-falling-in-a-blow-to-farmers-51580482811 (“Piles of hemp ‘biomass’ sit unsold, and the price of what did sell fell 30% from December to January.”); https://www.reporterherald.com/2020/05/18/enthusiasm-leads-to-oversupply-of-hemp-in-colorado/ (Prices on hemp in Colorado have dropped from $40/pound in Summer 2019 to $10/pound; “The current oversupply means that there is a ‘significant volume of biomass that’s still in storage,’ which could help keep prices down as older hemp is less valuable than a freshly harvested crop.”).

5 https://www.cnbc.com/2019/11/02/trade-wars-climate-change-plunge-the-family-farm-into-crisis.html (“Farm bankruptcies through September surged 24% versus the prior year…the suicide rate for farmers is 1.5 times higher than the national average.”)

6 https://www.messenger-inquirer.com/news/the-sun-wont-set-on-kentucky-hemp/article_2ecdb857-1d73-52cc-97e0-648276fd6260.html

7 https://www.votehemp.com/wp-content/uploads/2021/03/VH_2020_Crop_Report_final.pdf.

8 https://www.farmers.gov/cfap; See also https://hempindustrydaily.com/hemp-industry-daily-taking-stock-of-how-coronavirus-has-affected-farmers-businesses/ (54% of hemp companies have reported that applications for COVID-19 relief funds have gone unanswered, and another 29% report their applications being denied outright or relief loans going unfulfilled.)

9 https://hempindustrydaily.com/cbd-companies-see-online-sales-spike-as-coronavirus-shuts-down-retails-shops/ (While online sales spike, major CBD manufacturers experience significant losses from 2019 to 2020); https://www.hempbenchmarks.com/hemp-market-

insider/expectations-for-2020-hemp-growing-season-shift-covid-19-impacts/ (70% of survey respondents reported April sales were “below expectations due specifically to COVID-19.”)

10 https://www.forbes.com/sites/davidcarpenter/2020/03/18/hemp-company-files-for-bankruptcy-as-confounding-regulatory-guidelines-hamper-growth/#417b60955794

11 https://www.winchestersun.com/2020/02/06/gencanna-files-for-chapter-11-bankruptcy/

12 https://hempindustrydaily.com/kentucky-extractor-elemental-processing-files-for-bankruptcy-protection/

13 https://www.thefencepost.com/news/gencanna-exec-blames-fda-for-hemp-industry-troubles/; (GenCanna: FDA’s “uncertainty over how to regulate hemp…has diminished the interest of big companies in hemp food products and ‘frozen’ processors access to capital.”);

https://www.forbes.com/sites/davidcarpenter/2020/03/18/hemp-company-files-for-bankruptcy-as-confounding-regulatory-guidelines-hamper-growth/#417b60955794 (Atalo: “The path to growth has been impeded by confounding guidance from regulatory agencies.”)

14 https://www.forbes.com/sites/mergermarket/2020/04/27/precipitous-decline-in-hemp-and-cannabis-ma-continuing-amid-covid-19-pandemic/#2d8825375c05

15 https://moblyft.com/blog/how-to-advertise-cbd-on-facebook-and-instagram/

16 https://www.classaction.org/media/fausett-et-al-v-koi-cbd-llc.pdf; https://www.classaction.org/media/dasilva-v-infinite-product-company-llc.pdf

17 https://www.courtlistener.com/docket/17027232/third-wave-farms-llc-v-pure-valley-solutions-llc/

18 https://www.marijuanamoment.net/mitch-mcconnell-talks-cbd-regulations-with-fda-head/

19 https://www.kyagr.com/ky-agnews/press-releases/2020/Quarles-Urges-FDA-End-Bureaucratic-Paralysis-Hemp-Regulatory-Decisions.html

20 https://www.naturalproductsinsider.com/ingredients/fda-commissioner-deeply-focused-cbd-issues

21 https://www.nutraingredients-usa.com/Article/2020/02/28/FDA-chief-Hahn-says-it-would-be-fool-s-game-to-try-to-shut-down-CBD-markets

22 Acting FDA chief suggests no quick solution to CBD ‘stalemate’ (naturalproductsinsider.com)

23 See e.g., https://www.sciencedirect.com/science/article/pii/S2214750019305207;

https://www.hindawi.com/journals/jt/2018/8143582/;https://pubmed.ncbi.nlm.nih.gov/32268347/;

https://www.tandfonline.com/doi/abs/10.1080/19390211.2020.1767255

24 https://validcare.com/press/validcares-clinical-study-reports-preliminary-results-of-cbd-liver-safety/ (Clinical research showed “no evidence of liver disease in the 839 participants and no increase in the prevalence of elevated liver function tests when compared to a population with a similar incidence of medical conditions.”)

25 See e.g., self-GRAS affirmations from Charlotte’s Web (https://www.prnewswire.com/news-releases/charlottes-web-achieves-self-affirmed-gras-status-301025721.html); CV Sciences (https://ir.cvsciences.com/press-releases/detail/85/cv-sciences-inc-achieves-industrys-first-hemp-extract); and Manitoba Harvest (https://www.prnewswire.com/news-releases/manitoba-harvest-announces-broad-spectrum-hemp-extract-self-affirmed-gras-status-300858631.html#:~:text=MINNEAPOLIS%2C%20May%2031%2C%202019%20%2F,Recognized%20as%20Safe%20(GRAS)

26 https://hempsupporter.com/assets/uploads/2019.07.16-US-Hemp-Roundtable-FDA-Comments.pdf (Industry study showed percentage of adverse effects reported between .01 and .1%)

27 https://www.who.int/medicines/access/controlled-

substances/CannabidiolCriticalReview.pdf

https://www.who.int/medicines/access/controlled-substances/CannabidiolCriticalReview.pdf

28 https://www.tga.gov.au/alert/review-safety-low-dose-cannabidiol

29 https://www.tga.gov.au/media-release/over-counter-access-low-dose-cannabidiol

30 https://www.food.gov.uk/news-alerts/news/food-standards-agency-sets-deadline-for-the-cbd-industry-and-provides-safety-advice-to-consumers;

31 See e.g., Bill Text – AB-45 Industrial hemp products. (ca.gov); https://regs.health.ny.gov/sites/default/files/proposed-regulations/20-21hemp.pdf; New Hemp Rules in Effect January 1 / 2020 Press Releases / Press Releases / News & Events / Home – Florida Department of Agriculture & Consumer Services (fdacs.gov); Texas Administrative Code (state.tx.us)

32 Unregulated and Exploding: How the CBD Market Is Growing Amid a Labyrinth of State Approaches and Rampant Consumer Confusion – Consumer Brands Association

33 https://jamanetwork.com/journals/jama/fullarticle/2661569; (Only 30% of tested CBD products accurately labeled.);

https://www.marijuanamoment.net/fda-notifies-public-about-recall-of-cbd-product-that-tested-high-for-lead/ (Florida regulators prompt national recall of CBD product that tested high for lead.)

34 https://hempsupporter.com/assets/uploads/CBD-Marketplace-Sampling_RTC_FY20_Final.pdf; See also, https://www.fda.gov/news-

events/speeches-fda-officials/remarks-lowell-schiller-jd-council-responsible-nutrition-conference-1172019-11072019 (FDA’s Lowell Schiller:

“Many of the manufacturers entering this space lack experience with FDA or DSHEA, and we have serious concerns about issues like harmful contaminants such as pesticides, heavy metals, or other drugs like THC.”)

35 What Is Delta-8-THC?: The Hemp Derivative That’s a Hot Seller – The New York Times (nytimes.com);

https://www.politico.com/news/2021/03/27/rise-of-delta-8-thc-478215

36 https://hempindustrydaily.com/wp-content/uploads/2019/10/Hemp-CBD-Factbook-2019-executive-summary_FINAL.pdf

37 https://www.foodnavigator-usa.com/Article/2020/07/28/What-s-the-size-of-the-hemp-derived-CBD-prize-Brightfield-Group-releases-new-report

38 https://hempsupporter.com/assets/uploads/cowen2020report.pdf; See also https://www.marketsandmarkets.com/Market-

Reports/industrial-hemp-market-84188417.html (“The industrial hemp market is projected to grow from USD 4.6 billion in 2019 to USD 26.6 billion by 2025…The food segment is projected to account for the largest market share in the industrial hemp market during the forecast period.”); https://bdsa.com/u-s-cbd-market-anticipated-to-reach-20-billion-in-sales-by-2024/ (US sales of “CBD products to surge from $1.9 billion in 2018 to $20 billion by 2024…majority of CBD product sales will soon occur in general retail stores.”)

39 2021 US CBD Market Report (brightfieldgroup.com)

40 POLITICO Pro | Newsletter

41 https://www.forbes.com/sites/janellelassalle/2019/09/11/why-cbg-cannabigerol-expensive-produce/#2881d972f771

42 https://www.cannabisbusinesstimes.com/article/projections-us-leads-in-global-hemp-cultivation/

43 How Much Does Epidiolex Cost? (The Cost May Shock You) – Nature by Science

44 History and overview of DSHEA – PubMed (nih.gov)

45 https://ushempauthority.org/