After years of unrealized expectations, it finally looks as though the hemp industry is on an unstoppable train moving full steam ahead. Entrepreneurs who are keeping up with the latest industry news and eye-popping market trends are certainly well-aware of the potential upside with these ventures. That said, if these aspiring entrepreneurs do not fully understand what they are getting themselves into when it comes to their financial partners, they could be in for a world of hurt.

The Importance of Choosing the Right Financial Partner

In just the past 18 months, there have been countless horror stories of unreliable payment processing providers and banks that have left hemp-related businesses anxious, frustrated, helpless, and in some cases, out of business.

- Horror Story #1 – After a few short months of accepting hemp and CBD merchants, Elavon (a subsidiary of U.S. Bancorp) abruptly sends letters to merchants indicating their accounts would be shut down as a result of the Company no longer serving the industry.

- Horror Story #2 – Bank of the West/Bank of Modesto and Bank of Commerce start processing for hemp and CBD businesses but quickly become backlogged with applications and are unable to keep up with the underwriting. Thousands of merchants are charged a $250 application fee and are still not processing six months later.

- Horror Story #3 – Some merchant service providers who use Fifth Third as their bank claim that Fifth Third Bank accepts hemp and CBD payments, but C-Level executives at the Bank boldly disagree. This is one of many examples of a merchant service provider not being on the same page as their bank regarding the hemp industry.

- Horror Story #4 – Square launches a beta program for hemp and CBD businesses and, shortly thereafter, begins withholding 10-30% of their customers funds in a “reserve account” without warning or explanation.

Whether it’s getting shut down, paying exorbitant fees, or being misled by sales reps at every turn, hemp-related businesses continue to be placed in a vulnerable position that hinders their ability to grow. These businesses simply do not have time to find a new financial service partner – especially when they are trying to compete in one of the fastest growing industries in the U.S.

If a hemp company engages a bank or credit card processor with little to no experience in the industry, problems are sure to follow. The relationship may work for some time but when the bank’s internal compliance team or an external regulatory agency catches on, merchants could lose their ability to process transactions. Worse yet, they may lose their ability to accept credit cards forever, regardless of whether or not they are aware of what’s happening behind the scenes.

Furthermore, when and if it does come time to switch payment processing providers, voluntarily or not, hemp and CBD businesses can’t get up and running with a new processor overnight. It just doesn’t work like that.

Unlike merchants that sell low-risk products, hemp merchants are required to complete a brand new application, undergo a thorough underwriting process and are subjected to AML (Anti-Money Laundering) and KYC (Know Your Customer) due diligence procedures – which could take weeks or even months – all with no guarantee they will be approved and back online to do business.

What Does A Full-Service Banking Relationship Look Like?

When considering how to grow your hemp business, you should be looking for an experienced financial service partner in the Hemp and CBD industry that understands the various regulatory issues impacting the entire financial services landscape and how having these services provided by a single entity can be beneficial to the overall relationship. A “full-service banking relationship” provides access to a comprehensive suite of services, such as compliance monitoring, depository, treasury management, lending and payment processing services to name a few. This powerful combination of resources, all under one roof, not only helps eliminate compliance concerns, but also enhances the overall relationship between you and your financial partner.

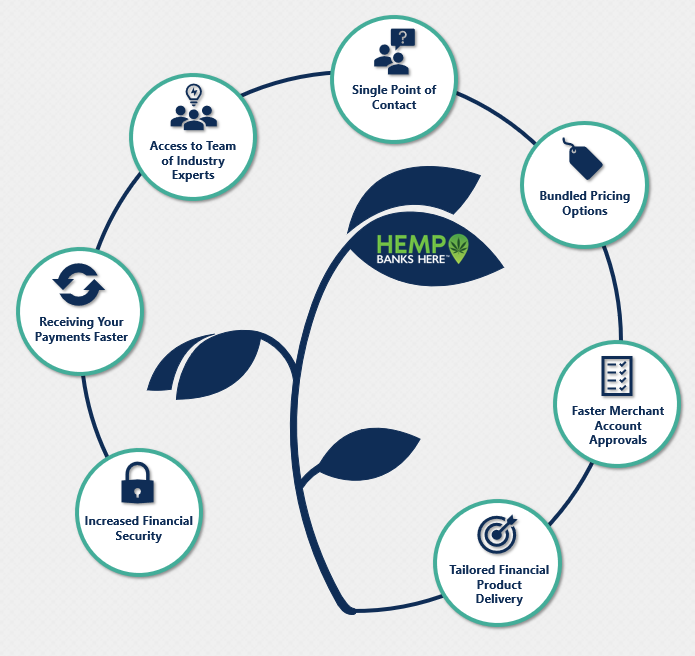

7 Benefits to Using A Full-Service Banking Partner

1. Increased Financial Security

As we saw in earlier examples, payment processing providers are often times not on the same page as their banks. If there is a lack of communication and transparency between these two parties, it’s simply a matter of time before the payment processing provider is asked to find a new bank which can result in shut downs or other issues for the customers who use them to process their payments.

Using a full-service banking partner ensures that your credit card processing and banking transactions are in lockstep with each other. This greatly reduces the risk of any unforeseen issues with your financial activity, allowing you to focus on growing your business with confidence.

2. Receiving Your Payments Faster

Bundling payments with commercial banking services can allow you to receive the revenue you generate from credit card transactions quicker. In most cases, businesses get funded next day, possibly the same day, creating predictable cash flow for the business.

3. Access to a Comprehensive Team of Hemp Industry Experts

Having a deep relationship with a financial partner that specializes in the hemp space ensures that you have a team of experts looking out for your best interest as a company. By having your banking and payment processor under one roof, your partner has access to all of the data they need to make suggestions, solve any array of compliance problems and help you achieve your goals as a company.

On the flip side, having separate financial relationships means that your partners only have access to part of your financial story, which can often lead to uncertainty and a lack of complete understanding about your business.

4. Single Point of Contact for Your Financial Needs

Working will a full-service banking partner means that you now have a one-stop-shop for all of your financial products or questions. Typically, hemp businesses would need to maintain two completely separate relationships and know where those relationships stand at any given time, creating additional work or other inefficiencies for the business.

5. Bundled Pricing Options

When your banking and payment processing services are offered by a single provider, hemp businesses can take advantage of bundled pricing options at discounted rates. This will likely be dependent on volume levels and other products and services being utilized.

6. Faster Merchant Account Approvals

Partnering will a full-service solution means you only have to provide the necessary documentation once in order to get your financial services up and running. When this data is shared between your bank and payment provider, this results in faster merchant account approvals, allowing merchants to start accepting payments sooner.

7. Tailored Financial Product Delivery

Banks that have access to payment transaction and depository data can more effectively anticipate customer needs for additional bank products, such as lines of credit, treasury management services and online banking tools.

This allows them to tailor the products they offer to you depending on the most pertinent needs of your business, arming you with the financial tools you need to help your business succeed.

In today’s world of banking, Hemp-Related Businesses (HRBs) create unique challenges for traditional banks and credit card processors not familiar with the Hemp and CBD industry. The fear that the right hand does not know what the left hand is doing is a real concern. Partnering with a full-service banking partner with an in-house team of industry experts can allow you to navigate the financial world with confidence. Having the proper oversight and guidance allows hemp companies to align their operational growth with that of a rapidly growing industry without having to worry about aspects that hinder performance. Through full-service banking relationships, hemp and CBD businesses can bundle financial service solutions for an end-to-end tailored approach all while increasing revenues, reducing risk and having access to better overall service.

About West Town Payments, LLC

West Town Payments, LLC and West Town Bank & Trust have partnered together to offer a full-service banking offering to hemp and CBD businesses. West Town Payments provides compliance-focused, technology-enabled payment processing solutions to merchants throughout the U.S. The Company offers a highly secure, comprehensive commerce platform for physical point-of-sale, online, contactless and mobile merchants, with West Town Bank & Trust providing merchant deposit accounts and treasury management services on the back end. In addition to its strategic banking partnership, West Town Payments is a direct acquirer through Visa, Mastercard, Discover, and American Express, and is well-equipped with the experience, resources and compliance-driven framework to partner with hemp-related business.

About the Author: Tom Lineen is the Co-Founder and CEO at West Town Payments. With over 20 years of payment solution expertise, he effectively navigates and advocates for compliance-driven and traditional business verticals, through old-fashioned values centered around integrity and transparency coupled with innovative, modern technology. Along with his strategic leadership roles in FinTech companies, he is an active angel investor, board member, mentor, and advisor to several exciting and disruptive companies in the predictive analytics, B2B payments, and Insurtech space. To learn more visit www.westtownpayments.com or email hello@westtownpayments.com.